Buying an electric car could become easier for Victorians as the state government announces a new $ 3,000 subsidy.

This grant applies to Zero Emissions Vehicles (ZEV) and will be available for up to 20,000 vehicles from May 2, 2021.

According to the Andrews administration in Victoria, this package is part of a $ 100 million pledge that all-electric or hydrogen-powered cars will account for half of all new car sales by 2030.

Victorian Minister for Energy, Environment and Climate Change Lily D’Ambrosio said the state’s transport sector was a major contributor to emissions.

“This reform package makes cars the vehicles for change by putting more zero-emission vehicles on our roads,” she said.

Treasurer Tim Pallas, meanwhile, said these investments “will encourage more drivers to consider buying a zero-emission vehicle – and ensure that Victoria leads the nation in zero-emission vehicle adoption.”

See also: ‘Discount for electric cars’ on the voting slip in the next general election

In the market for an electric car? The table below lists auto loans with some of the lowest fixed interest rates on low emission vehicles on the market.

Other government subsidies for electric cars

Currently, Australia has mostly government incentives to encourage electric vehicle (EV) purchases, which are little offered at the federal level.

In addition to this new subsidy of USD 3,000, the following incentives are available to would-be owners of electric and hybrid cars:

Confusion over the Victorian government’s two-way approach to electric vehicles

This announcement of a $ 3,000 break for car buyers and a $ 19 million investment in charging infrastructure received praise from some industry groups.

The Federal Chamber of the Automotive Industry (FCAI), for example, backed this, saying it worked closely with the government to increase the adoption of electric vehicles.

“The FCAI thanks the Victorian Government for their consultation on this matter and we look forward to further development through the Victorian Government’s Expert Advisory Board to ensure that there are achievable, practical and innovative long-term strategies in place to meet long-term goals. common goals for CO2 Reduce emissions, “said Tony Weber, chief executive of the FCAI.

“The FCAI has consistently advocated a national approach to these issues, which is ideally led by the federal government in order to avoid the prospect of individual state governments introducing their own standards and incentive programs to support the ZLEV.”

However, Mr Weber also noted that this new package calls into question the Victorian government’s new electric vehicle road charge, the “electric vehicle tax” which 25 different organizations have dubbed “the world’s worst EV policy” (see below).

“The pricing decisions for road users should not be based on certain technologies, especially not on those that are still in their infancy in the Australian market,” said Weber.

“An efficient road user charging scheme can appeal to all vehicle users, regardless of the type of vehicle they drive, how often it is driven and the purpose of the journey.

“The FCAI will be keen to work with the Victorian and other governments to explore the benefits of the wide-ranging tax and vehicle fee reform.”

What is the Victorian “Electric Vehicle Tax”

The Victorian road user fee is expected to begin July 1, 2021, provided that it is passed by Parliament in early May.

Essentially this would include fee a tax of 2.5 cents per kilometer for fully electric vehicles and 2 cents per kilometer for plug-in hybrid vehicles.

According to Vic Roads, this would mean the average EV owner could expect an additional $ 330 road cost per year. According to The Australia Institute, this would be the first tax in the world to directly make buying an electric vehicle difficult.

In an open letter from the Australia Institute, 25 different organizations called this proposal “the world’s worst EV policy”. including:

- Car manufacturers like Hyundai and Volkswagen

- Climate lawyers like the Clean Energy Council, Smart Energy Council, Australian Conservation Foundation, and more

- Automotive organizations such as the Electric Vehicle Council and the Transport Alliance

- Other companies like Uber and Charge Fox

“No other jurisdiction has introduced such a targeted levy on the cleanest vehicles on the road without substantial incentives to offset this,” the letter said.

“Most developed countries prioritize incentives for electric vehicles to benefit from cleaner air and new jobs in a growing industry.

“This new tax means that the world’s manufacturers are far less likely to send Victorians their best, cheapest, zero-emission vehicles.”

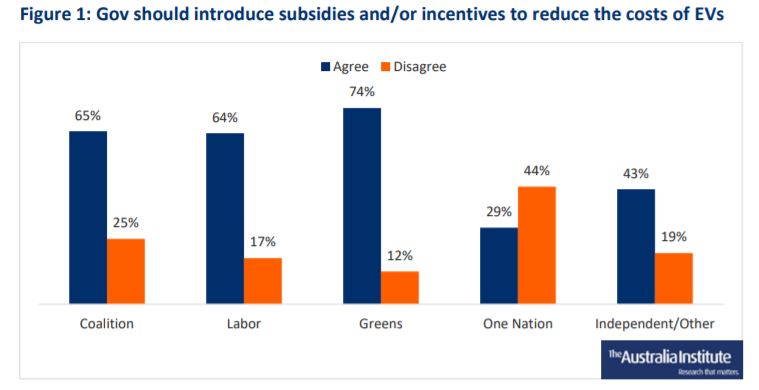

Most Australians seem to agree to further EV incentives regardless of major party affiliation.

However, the Victorian government said their new $ 3,000 EV subsidy was made possible by expected road toll revenue. She said it “comes in at a fraction of the road taxes and fees that other vehicle owners pay, and the entire road ensures that users contribute to the maintenance of our roads”.

Related: Affordable Electric Cars in Australia

Photo from Science in HD on Unsplash

When selecting the above products, the entire market was not considered. Rather, a reduced portion of the market was considered, which includes retail products from at least the four major banks, the top 10 customer-owned institutions, and Australia’s larger non-banks:

Some vendors’ products may not be available in all states.

In the interests of full disclosure, Savings.com.au, Performance Drive and Loans.com.au are part of the Firstmac group. To learn how Savings.com.au handles potential conflicts of interest and how we get paid please click the website links.

* The comparison rate is based on a loan of $ 30,000 over a 5 year period. Warning: This comparison rate applies to this example only and may not include all fees and charges. Different conditions, fees or other loan amounts can lead to a different comparison rate.