Martin Lewis has warned drivers and homeowners of a new auto and home insurance law that will come into effect in January.

The personal finance expert, who appeared on his ITV Money Show Thursday night, told viewers that “the window of opportunity for a cheap offer is now”.

He explained that consumers could save a lot by shopping with their provider or switching to a better deal.

Read more money news here.

From next year it will be forbidden for home and car insurances to raise a “loyalty bonus,” reports Der Spiegel.

That means they can no longer bill customers who renew every year – just because they know they will stay.

And while that’s good news, Martin cautioned that it means customers are likely to see less competition in the market.

“There’s a big rule change coming up on January 1st,” he said.

“This affects car, motorcycle, van and household insurance. This is the end of the loyalty bonus and the end of price changing.

“This means that if you automatically renew your policy, your insurer can no longer increase the price year after year.”

Martin said it is likely that existing and new customer prices will meet in the middle, which means there could be less competition.

“In other words, the savings will go down dramatically for people who compare and save every year,” he said.

The changes will go into effect in January, but Martin warned many insurers that they will update their prices to reflect the change in the law next month.

Video is loading

Video not available

Click to play

Touch to play

The video will soon start playing automatically8thAbort

Play Now

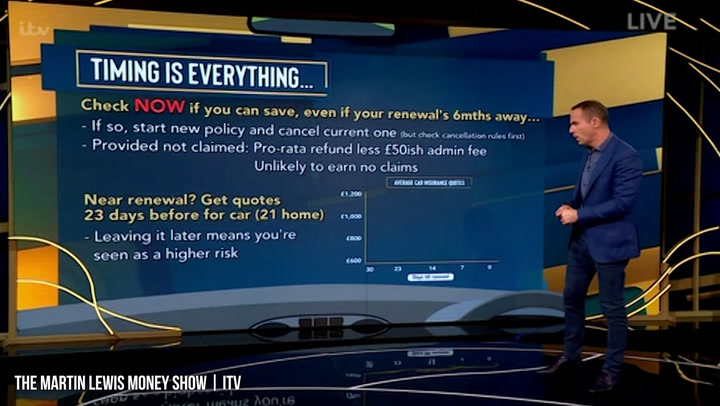

He gave advice to viewers and said it’s worth checking out if you can save – even if your renewal policy is six months away.

“If you find that you can save a lot, start a new policy, cancel the old one and ask for a refund for the outstanding period.

“Provided you have not made a claim, you should receive a pro-rated refund less approximately £ 50 in administration fees.”

If you’re about to renew, the perfect time to get quotes is 23 days before your auto insurance expires or 21 days for home insurance.

“The reason for this is that if you let it on later, insurers will categorize you as a higher risk person and charge you higher.”

Video is loading

Video not available

Click to play

Touch to play

The video will soon start playing automatically8thAbort

Play Now

Finally, he gave some advice to those shopping in the area.

“Two different comparison websites can have different prices for different insurers, so use two or more. Some insurers like Direct Line aren’t on comparison sites either, so check them out one by one, ”he said.

“And if you want to stick with your provider, find the cheapest deal and contact them to match them or haggle lower.”

Those looking for a cheaper deal can potentially save more through a cashback website like TopCashback or Quidco. Some pay up to £ 70 if you join through them.

“After all, insurance policies are like loans, so pay upfront and pay the least.”

New “price walking” rules from January 2022

Many companies raise prices for existing customers when they renew in a practice known as price walking.

They use sophisticated processes to get the best deals out to customers who they believe they won’t switch in the future and will therefore pay more in the long run.

This is one of the reasons people are encouraged to look around and switch every year.

At the same time, these companies are offering new customers at low prices in order to attract them.

The new rules of the FCA prohibit price walking from January next year.

The change in the law will protect people from the so-called “loyalty bonus”. In short, this means that your renewal price will not be higher than if you had joined the same company as a new customer.

It said these measures will save consumers £ 4.2 billion in 10 years.

Would you like more messages straight to your inbox? Sign up here for our daily newsletter.