European car buyers saw sales grow 63% in March as market data reflected a recovery from COVID-19 and Tesla’s Model 3 topped the EV rankings.

However, the global analyst at Jato Dynamics said more needs to be done to “increase sales and restore consumer confidence” as pressures mount to switch to alternative fuel vehicles (AFV) after the pandemic.

Jato’s monthly report covering 26 markets across Europe showed volume increased from 842,094 to 1,374,313 units per year after the month of bulk retailers and factories closing when the COVID-19 pandemic first hit the region .

The result, however, remains the second lowest month of registration since 2013 and only makes the total market rise by 1% in the first quarter with 3,045,703 sales – the second lowest total sales in the first quarter since 1986.

Munoz said: “The European auto market is still a long way from reaching pre-pandemic volume and governments need to take further action to boost sales and restore consumer confidence.”

Jato reported that electric vehicles (EV) and SUVs continue to be the top growth drivers in Europe, with the Tesla Model 3 ranking fourth in the overall sales rankings last month.

In a month in which Tesla detailed the expansion of its UK store network, the Model 3 was the best-selling electric vehicle in the UK, France, Norway, Italy, Austria, Sweden, Switzerland, the Netherlands, Denmark, Portugal, Poland, Greece and Slovenia , Croatia and Germany in front of the Volkswagen ID.3.

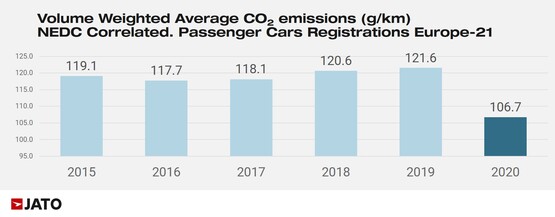

Electric vehicles recorded a record 16% market share in March 2021 – up from 9.7% in March 2020 and just 3.4% – as AM reported warnings that adoption needs to be increased even further if the EU reduces its CO2 emissions in the Aims to meet goals as part of the “Green Deal”.

The extra traction came when diesel cars recorded their lowest market share ever at just 24%.

Munoz said consumers responded positively to larger and more competitive EV offerings backed by significant government-sponsored incentives and tax breaks in countries like Germany and Norway.

Munoz said consumers responded positively to larger and more competitive EV offerings backed by significant government-sponsored incentives and tax breaks in countries like Germany and Norway.

But he added, “The positive effects have not yet offset the large declines in traditional high-emission fuels.”

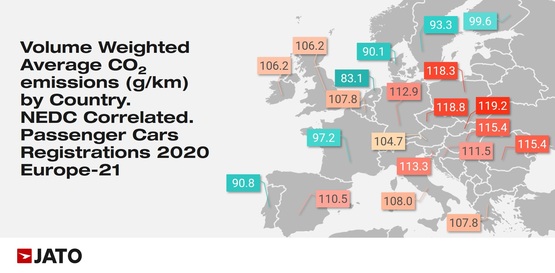

The UK’s average new car emissions in March ranked 8th among the 26 nations analyzed by Jato.

According to Jato, the market share of SUVs rose from 37% in March 2019 and 40% in March 2020 to 45% last month.

In Sweden, Norway, Slovenia and Hungary, SUVs gained more than 10 percentage points of market share year-on-year.

Munoz continued, “The success of electric vehicles and SUVs is a good indicator that consumer demand will soon be focused on upcoming electric SUV models, which will be a major growth driver for the future industry.”

The latest EV SUVs to hit the market include the Vauxhall Mokka-e, Lexus UX300e, and Citroen e-C4.

In March, Volkswagen Golf regained its position as the most registered car in Europe with 26,265 units – an increase of 12% compared to March 2020.

Electrified versions (PHEV and MHEV) of the Golf accounted for 36% of the model volume in the German home market of the hatchback model.

Peugeot’s 208 took second place with just 836 units and ended the first quarter as the bestseller of the period.

The Opel / Vauxhall Corsa also did well, clearly outperforming the Renault Clio and Volkswagen Polo, Jato reported.